The Global Diffusion of Special Economic Zones: Evidence from Ethiopia and Vietnam

By Keyi Tang

There are over 5,000 Special Economic Zones (SEZs) in the world. About 75 percent of developing economies and almost all transition economies use these geographically bound areas in which governments facilitate industrial activity through fiscal and regulatory incentives and infrastructure support in their early stages of industrialization.

Why have SEZs traveled so far and fast globally? How do SEZs vary across national contexts?

My new journal article published in Review of International Political Economy shows that the recent wave of SEZ adoption among developing and transition economies is rooted in their desires to catch up with increasing economic competition and globalization. It also finds that a coalition between the Newly Industrialized Economies’ (NIEs) governments, private investors and state-owned companies actively promoting their model overseas become the key policy ambassadors in the globalization of SEZs while expanding NIE capital to emerging markets. Moreover, the variation of SEZ policy in national contexts, however, is constrained by existing institutional settings.

This research draws on semi-structured field interviews with 53 key government officials, local scholars, foreign SEZ managers and investors in Ethiopia and Vietnam, two countries that were rising stars in their respective regions’ growth turnaround. In tracing the process of Ethiopia’s SEZ development between 2002-2018 and Vietnam’s between 1986-2005, I focused on four cases that were respectively the first SEZs and the flagship state-run SEZs within each country: the Eastern Industrial Zone and the Hawassa Industrial Park in Ethiopia, as well as the Tan Thuan Export Processing Zone and the Chu Lai Open Economic Zone in Vietnam.

The case studies demonstrate that Ethiopia learned tremendously from mainland China, while Vietnam mostly learned from Taiwan in their early-stage SEZ administrative and legislative frameworks. Ethiopia and Vietnam did not establish their first SEZ until five years after they initiated SEZ development plan, only after Chinese and Taiwanese investors provided the essential financial and technical support. Encouraged by Chinese and Taiwanese foreign policies to expand overseas markets, the investors not only brought the SEZ concept, but also pushed the establishment of early-stage SEZ laws and administrative agencies in host countries. The active policy learning of host countries’ elites from NIEs’ SEZ development experiences is essential to shape a consensus to deploy SEZ as a new national policy to attract foreign direct investment (FDI) and facilitate industrialization.

However, path dependency to historical institutions constrains policy localization in the later stages of SEZ development. While Ethiopia adopted a centralized SEZ management, Vietnam chose a decentralized SEZ development model. Ethiopia’s centralized SEZ management system aligns with the Ethiopian People’s Revolutionary Democratic Front’s (EPRDF) state-building attempts to centralize state capacity in an ethnically divided, developmental and patrimonial state. Vietnam’s homogeneous ethnicity does not require the Vietnamese Communist Party (VCP) to cement national identity through centralization. On the contrary, the VCP’s legitimacy crisis caused by over-centralization was a principal cause of its market reform. This administrative decentralization allowed Vietnam’s provincial governments to enjoy some level of autonomy to experiment with new policies but also led to a race-to-the-bottom competition between local governments for foreign direct investment (FDI).

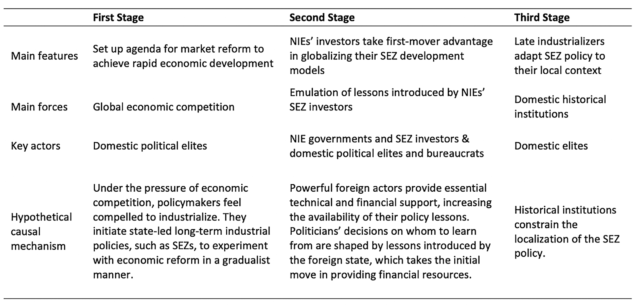

Based on these findings, I developed an SEZ policy adoption framework for developing countries. As Table 1 and Figure 1 show, the framework examines the different mechanisms underpinning the three stages of SEZ policy adoption. The initial agenda-setting stage is driven by the pressure of global economic competition. The second stage is mimicry of institutional settings for SEZ development, dominated by political elites emulating lessons from foreign actors. NIEs’ investors have a first-mover advantage in transferring their SEZ development lessons to late industrializers. Finally, path dependency plays a crucial role in late industrializers’ adaptation of foreign SEZ development models to their local context. Overall, the research highlights the crucial role of the state in emulation and developing structural transformation strategies.

Table 1: A Framework of SEZ Policy Transfer

Figure 1: SEZ Policy Transfer Framework for Late Industrializers

I offer three key recommendations for developing countries using SEZ policies for industrialization.

First, host countries should grant more autonomy to local SEZ authorities in making their own legal and administrative institutions to attract investors. Without autonomy, it might be hard to turn experiences learned from foreign countries into policies used in practice. Ethiopia and Vietnam’s learning experiences show that policy learning must involve adapting foreign lessons into the local context.

Countries should also pay attention to their environmental and social governance (ESG) practices while attracting FDI in SEZs. Vietnams’ SEZs often lowered their environmental and labor standards to attract foreign investors, leading to a race-to-the-bottom problem.

Finally, countries should allow more private sector participation in SEZ development. Ethiopia is facing debt solvency problem, which is partially a result of developing expensive state-owned SEZs through borrowing at commercial rates. In contrast, Vietnam’s most successful SEZs were developed through public private partnerships between Vietnamese government and NIE investors.

In all, formulating a cohesive long-term SEZ development strategy requires relatively strong state capacity and enduring political stability.

Read the Journal Article

*

Never miss an update: Subscribe to the Global China Initiative Newsletter.